AI and drones come to the farm in Japan

Oct. 6, 2020

Yoshinoya Farm Fukushima in northeastern Japan has undergone many trials and tribulations in recent years. The business employs 18 people growing cabbages, onions, and rice. Last year, water supplies were short. This year, in contrast, abundant rains led to a proliferation of weeds, and unfamiliar bugs plague the crops. For years now, Yoshinoya has dealt with a shortage of labor as Japan’s rural population shrinks.

“So many nonnative pests appear, we don’t even know their names,” says Kunio Takita, the farm’s manager. An unknown type of stink bug affecting the rice crop has been a particular challenge, he adds. “We are professional growers, but we lack information on what’s happening in the environment around our farm and how we should tackle the situation.”

Farmers across Japan confront challenges similar to Takita’s. To help them cope—and to capture more sales—crop protection chemical firms including BASF, Nihon Nohyaku, and Sumitomo Chemical are developing technologies not typically associated with farming, including drones and artificial intelligence. So-called digital farming, these firms say, will help farmers identify the pests in their fields and the best products to target them.

Technology may also help farms deal with the challenge of their shrinking workforce. Since 2014, according to the Ministry of Agriculture, Forestry, and Fisheries, the agricultural workforce has dropped by 1 million to about 1.7 million today. And the average age of farmers in Japan is 67.

Subhash Markad, director of BASF Japan’s agricultural solutions business, says he’s confident that new technologies will enable Japanese farmers to meet the challenges they face. In cooperation with Japan’s National Federation of Agricultural Cooperative Associations (Zen-Noh), the company is launching a suite of AI-based products under the Xarvio name. BASF acquired the Xarvio business from Bayer in 2018 and made the products part of its BASF Digital Farming unit.

Xarvio enables farmers to micromanage their crops. The first product to be launched, Xarvio Field Manager, is software that analyzes crop varieties, recent weather patterns, and satellite images to provide farmers with tailor-made growing models that include advice on what crop protection products should be used and how. In the near future, BASF plans to boost Xarvio Field Manager’s effectiveness by using data collected from sensors and cameras mounted on drones and tractors.

“Agriculture has become much more complicated,” Markad says. When people measure the value of a crop protection solution, “environmental impact, biological diversity, and value to society should be taken into account,” he explains.

Farmers increasingly need to supplement their own knowledge with digital technology tools, Markad adds. “Farming in Japan was once precisely based on the calendar and the accumulation of experience over time,” he says. “Now, farmers need to make realistic assessments because harvests are affected by an irregularity of seasons stemming from climate changes.”

Takita, the manager of Yoshinoya Farm, agrees. “Our experience of cultivation has not worked out that well in the past few years,” he says. “The farming co-op provides advice based on long-term weather forecasts, but it’s not enough.” Real-time digital assessment of field conditions would improve the more traditional farming methods the staff uses, he says.

Not surprisingly, much of the new technology is targeting rice, Japan’s largest crop by value. Rice is highly differentiated across Japan, with each prefecture cultivating its own subvariety. Different brands have distinct characteristics that the initiated can distinguish.

BASF has fed rice data from Japan into Xarvio Field Manager to optimize its algorithms. The firm will complete the process by next April when Xarvio moves from soft launch to a full-fledged marketing campaign, targeting not only the rice market but soybeans as well.

Generally, AI farming tools like Xarvio are helpful in complex growing environments. “Japan is very complicated,” Markad says. “From north to south, its weather ranges from sub-Arctic conditions in Hokkaido to subtropical temperatures in southern Kyushu.”

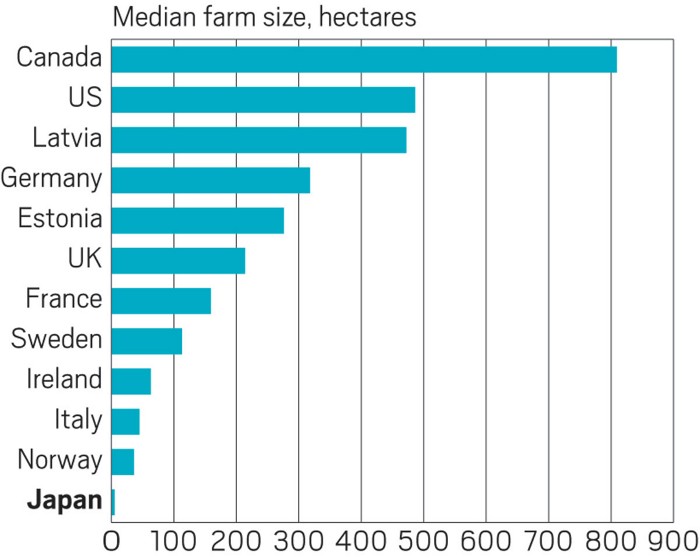

In addition, Japanese farms tend to be small—100 hectares at the most—and a single farm’s plots are often scattered throughout a region. Farmers need to vary their cultivation methods depending on which fields they’re working on. Xarvio Field Manager is helpful in those situations because it works with real-time data, Markad says.

FARM SIZE

Japan has some of the world's smallest crop farms.

Source: OECD Food, Agric. and Fish. Pap. 2016, DOI: 10.1787/5jlv81sclr35-en Note: Data are for 2009–12, depending on country.

BASF is not alone in using digital technology to enhance the effectiveness of crop protection products. Nihon Nohyaku has developed an AI-aided diagnosis app for disease-causing insects and weeds. Farmers take pictures of pests with their smartphones, and the AI matches the data to a particular type of agrochemical. Marketed as LeiMe, the technology was developed in 2017 in collaboration with the phone company NTT Data.

Over time, “the accumulation of data improves prediction and facilitates timely plant protection,” says Hideo Yamamoto, director and general manager of the domestic sales department at Nihon Nohyaku. Like BASF, the company is first marketing the technology for use with rice but will expand to other crops in the coming months.

Nihon Nohyaku trained LeiMe through exposure to masses of data to improve its accuracy. “We collected pictures of disease-causing insects and weeds in paddy fields by participating in a government-supported pilot project,” Yamamoto says.

Currently, the app provides farmers with probabilities about the accuracy of its answers. For example, after submitting a photo, a farmer might be told, “There is an 80% probability that this weed is Scirpus juncoides and a 20% chance that it’s Sagittaria pygmaea.” Farmers can complete the identification of pests themselves by using reference photos automatically provided by the app.

To market LeiMe, Nihon Nohyaku created a four-member marketing team named Smart Agriculture Promotion Office. Working with the agrochemical producers Nissan Chemical, Mitsui Chemicals Agro, and Nippon Soda, Nihon Nohyaku is aggressively promoting the app. So far it has been downloaded 18,000 times, 5,000 times by farmers. The other firms pay a small licensing fee to Nihon Nohyaku.

Building on its success in Japan, Nihon Nohyaku is considering promoting LeiMe abroad, possibly via licensing. “We have inquiries from Taiwan and India for business tie-ups,” Yamamoto says. But first, he adds, the technology’s accuracy needs to be further improved by adding data from other crops grown in Japan.

Sumitomo Chemical, meanwhile, has invested in the Japanese start-up Nileworks, which has developed an agricultural drone. Hovering 30–50 cm above the ground, the device delivers small doses of agrochemicals to plants below. Nileworks has sold over 100 drones so far.

The equipment is capable of forecasting each rice seedling’s nitrogen absorption, analyzing growth, and spraying agrochemicals with high accuracy, a Sumitomo spokesperson says.

i-Agri, a Sumitomo subsidiary, sells the drone for use in rice paddy fields. Sumitomo Chemical’s president, Keiichi Iwata, says R&D is ongoing to optimize agrochemical delivery. The company has applied for government clearance to spray several pesticide types by drone.

Sumitomo is also developing AI to optimize crop protection management by drone. The company is working with Purdue University on technology to help the drone visually identify each plant’s fertilizer and agrochemical needs. Sumitomo hopes to deploy it in Southeast Asia, China, and India.

Back at Yoshinoya Farm, Takita, the manager, hopes that high technology will also help ease the shortage of labor for Japan’s farms. This fall, the farm will start using drones to help with pest control on winter vegetables. In June, Yoshinoya deployed an automatic cabbage harvester.

Drones, robots, and AI could make agriculture more attractive to young people, Takita says, or at least make the sector less unattractive. “We can’t increase young people’s engagement in agriculture without wiping out its image as being hard work,” he says.

Katsumori Matsuoka is a freelance writer based in Japan.

More from AgroNews Change

Change

Subscribe

| Subscribe Email: | * | |

| Name: | ||

| Mobile Number: | ||

Comment

0/1200

0

0 Subscribe

Subscribe